When Su Joing Sollers shops for her hair products at the drugstore, she looks for products that are labeled for curl or texture.

“I limit my shopping based on those two words,” says Sollers, who purchases three to five products each month for her long, 3b curls

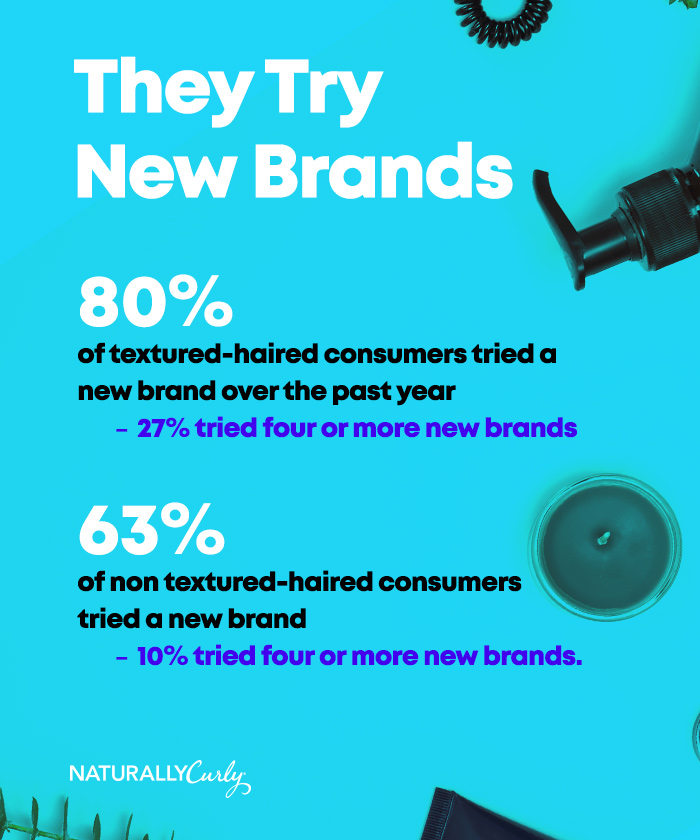

Sollers is not alone among textured-haired women. More than 80 percent of women with curly and coily hair say they purchase products specifically for textured hair rather than general market products, according to the 2018 TextureTrends Report from NaturallyCurly. An estimated 65 percent of the U.S. population has curly, coily or wavy hair, with a growing percentage of textured-hair women embracing their natural hair .

The eighth edition of TextureTrends report surveyed 2,000 consumers of all texture types, including consumers with naturally straight hair and those who chemical relax. The report explores many areas of purchasing behavior and product usage, including awareness, spend, retail preferences, and brand loyalty.

The number of textured-haired products for consumers like Sollers has soared, with hundreds of new skus launching every year. But less than 20 percent of the haircare shelf space at most food, drug and mass retailers is dedicated to products for texture, according to Lisa Brown, president of Lolique, a multicultural retail consulting firm.

And along with niche brands like Mielle, CURLS and The Mane Choice –developed specifically for textured-haired women – there has also been a push by general market brands like Head & Shoulders, Tresemme and Pantene to get their textured-hair skus into Texture planograms at retailers. Brown said she recently evaluated 275 new skus this year to add to the 4-foot shelf space for one large chain of drugstores.

In contrast, an average of 16 feet of space is dedicated to general market skus. Brown said it’s a “reverse Break the Walls” phenomenon, referring to the ground-breaking SheaMoisture ad campaign that promoted a more inclusive shopping experience in the beauty aisle rather than one that segregates products by ethnicity. Rather than texture brands being integrated throughout the aisles, brands all are vying for a place within this one textured-hair section.

The most important attribute for consumers when they are choosing where to shop for their haircare products is product selection for their texture, according to the TextureTrends report.

This is a missed opportunity for retailers, says Brown. “If you don’t have the space allocated to it, there’s only so much product you’re going to sell.”

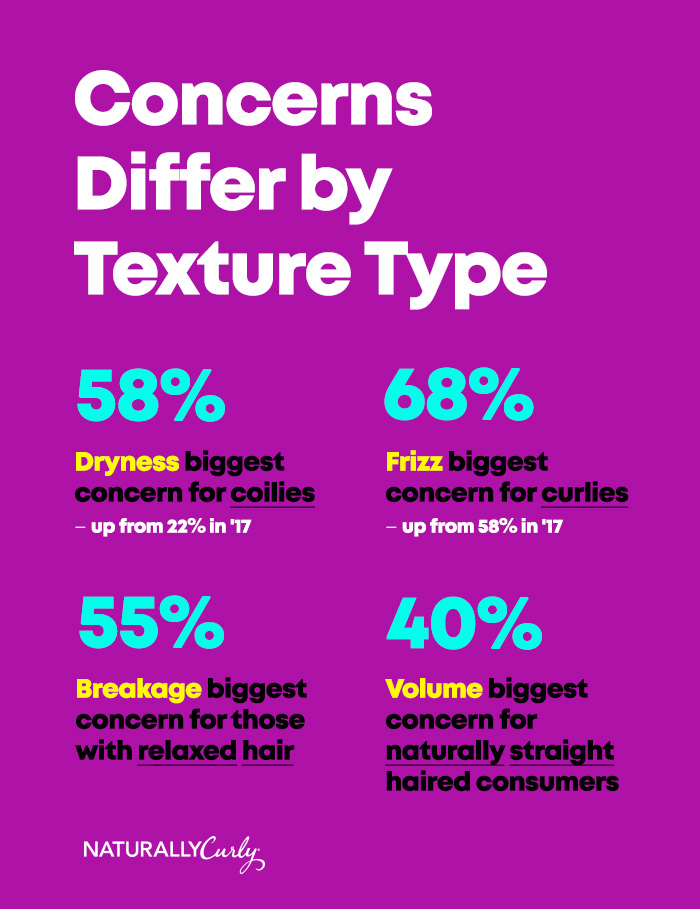

It makes business sense for brands to allocate more space to textured-hair products. Textured-haired consumers – a category that includes those with curly, coily and wavy hair – spend considerably more their straight-haired (naturally straight and those with chemically relaxed hair”> counterparts – an average of $205 a year versus $130 a year, according to the 2018 TextureTrends Report. Among all curl types, curly consumers spend the most – $247 per year. That’s 78 percent more than their straight-haired counterpart. With an average annual spend of $120 a year, those who chemically relax their hair spend the least of all textures.

“I always buy products specifically for texture – and I mean ALWAYS,” says Tina Harmon, who has locs and is the mother of a son with 4c coils. “There’s no other option!”

The looser the texture, the less important it is that a product or brand be aimed at a specific texture. For those with wavy hair, only 45 percent said it was important that the product be geared for texture.

“It doesn’t matter to me whether it’s for texture,” says Debbie Hampe, who has long, wavy hair. “What does matter to me is that the brand be free of animal products, gluten, proteins, aloe, silicones, sulfates and heavy oils.”

TextureTrends is available for purchase here.